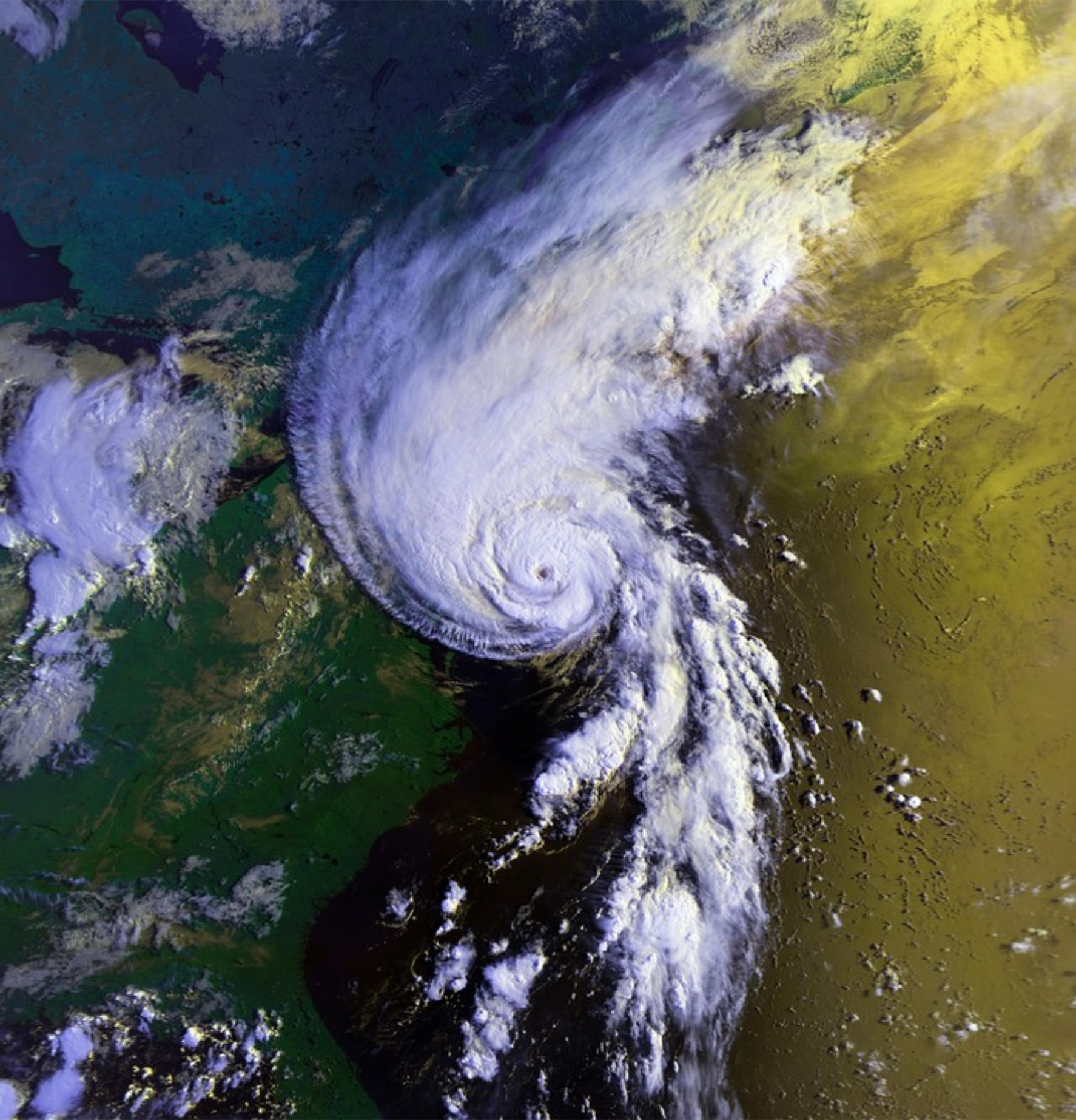

Rain, floods and windstorms: What the broker and the insured need to know

Due to the climatic events that happened recently in the states of the Northeast, South and Southeast regions, many Brazilians lost high-value goods. Homes, stores and automobiles are usually the most precious and most desired goods by Brazilians. Therefore, in the event of inclement weather, in which the insured may lose such treasured assets, insurance brokers and customers should be aware of the coverage offered.

Bradesco Seguros offers insurance for cars, companies and homes and, for all three products, there is coverage for accidents caused by rain, floods and windstorms. For Auto Insurance, the insured is fully guaranteed in case of bad weather, such as rain, wind or a tree falling on the vehicle. These are the basic coverages.

For Home and Business Insurance, basic coverage includes protection against fire, lightning and explosion. However, it is possible to protect the property from other risks, such as landslides, windstorms, hurricanes, cyclones, hailstorms, electrical damage and other services by contracting according to the needs of each property.

The executive superintendent of Bradesco Seguros, Rodrigo Herzog, highlights the importance of insurance, especially that which protects the home. “Although the frequency is lower compared to auto accidents, the severity of a home flood can often be much higher. The expense of recovering or cleaning a destroyed property is high for those who do not have insurance”, says the executive, who emphasizes that the price of insurance can be almost insignificant when compared to the value of the property. “It is an extremely positive cost-benefit ratio for the insured, if we think that he is protecting such an expressive asset”, he adds.

In cases of high demand for emergency calls from policyholders, as is the case when there is a period of heavy rains, Bradesco Seguros promotes Contingency Plans and the Emergency Claims Handling Operation, developed to quantify and indemnify policyholders involved in natural disasters in the shortest possible term. “This mobilization, in a special way, is extended until the normalization of the number of claims in the affected region. In order to maintain the level of service offered to policyholders, even in a period of adversity, we reinforced the internal contingent to support the increase in demand, in order to speed up the indemnification process. This year, more than R$ 37.4 million has already been disbursed to policyholders”, explains Herzog.

Share