Insurance expands protection for climate damage, reveals CNseg study

The seventh edition of the Insurance Sector Sustainability Report, produced by the National Confederation of Insurance Companies (CNseg), reveals that in the last three years the percentage of insurers that declared their concern with environmental, social and governance (ESG) issues at the time of developing products and services jumped from 43% in 2016 to 73.7% in 2021. Among the ESG issues that most impact the insurance sector are climate change

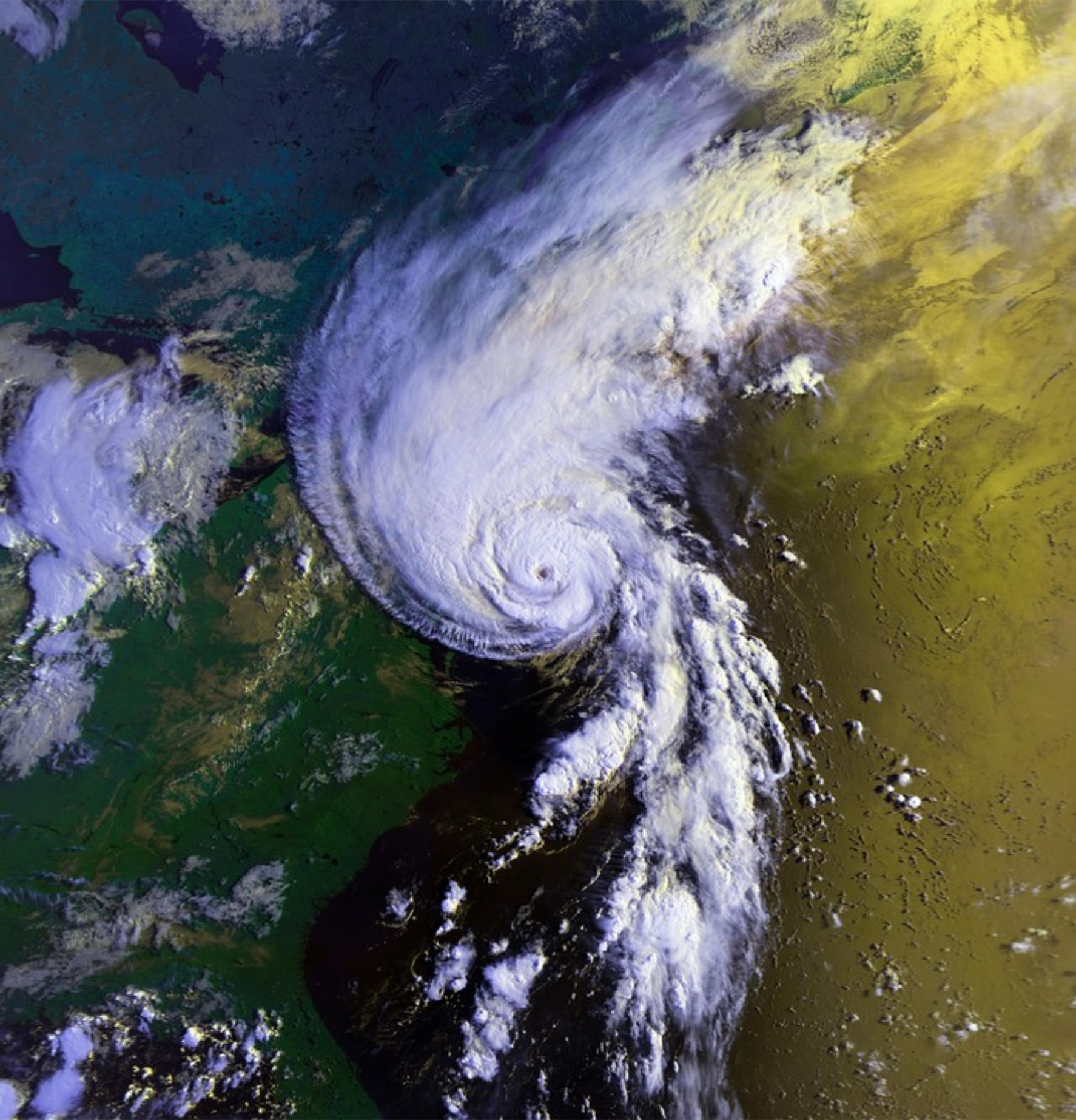

The superintendent of consumer relations and sustainability at CNseg, Luciana Dall’Agnol, explains that floods, droughts, epidemics, solid waste disposal and windstorms are some of the events related to climate change most cited by the insurers consulted for the report. “The increase in the frequency and severity of these events has the potential to impact the portfolios of companies in the sector, mainly because they can occur concentrated in a geographic region and result in indemnities for different branches, jeopardizing financial assets essential for the solvency of insurance companies”.

On the other hand, Luciana points out that changes in climate patterns also create business opportunities for companies with the creation of new products, services and assistance. “This is the case with parametric climate insurance, tailor-made to protect policyholders from climate indices that are harmful to their economic activities”.

Other examples of products developed by the insurance sector that consider ESG aspects include Environmental Civil Liability Insurance – which allows coverage of damages and expenses with environmental emergency actions that are directly consequent on the occurrence of an Environmental Pollution Event – environmental insurance for transport, developed especially for risks related to the transport of goods and waste, offering coverage for possible damages that a load, whether dangerous or polluting, may cause to the environment and even extended warranty with reverse logistics, an assistance that enables the environmentally correct disposal of products that are no longer used.

Also highlighted in the report is the increase in the number of insurers that include ESG (Environmental, Social and Governance) criteria in investment policy decisions, opting for issuance of greend bonds – sustainable debt securities – and debentures with an ASG (sustainable linked bonds) commitment. ). In 2016, 29% of the companies surveyed had this concern. Five years later, the number has evolved to 56.5% in 2021, a growth of 94.8%. The increase is even greater among insurers that have their own asset managers. If in 2016, only 14% had an ESG assessment methodology already implemented in the analysis and management of assets, currently, this number reaches 50%.

For the CNseg superintendent, despite the sector’s technical reserves being highly regulated, insurers demonstrate commitment to the ESG agenda when it comes to their investments. “Companies with good ESG metrics are more resilient and are associated with greater long-term value creation. This is because they are able to better manage socio-environmental risks and opportunities and have a robust governance structure that allows them to go through periods of crisis”.

The CNseg study also shows that the share of insurance companies that include the ESG theme in their business strategy increased from 77% in 2016 to 86.4% in 2021. “From the creation of the regulatory framework for sustainability in the insurance sector, Circular Susep at the. 666, the expectation is that the data from the next report will point to a rate of almost 100% adherence”, evaluates Luciana.

35 insurance companies participate in the CNseg Sustainability Report, which together hold an 85.7% market share in the Brazilian insurance sector. Adherence to the survey is not mandatory, but since 2016, it has been over 80%, which shows the importance of the topic for the sector.

Share