Insurers pay $112 billion in disaster claims in 2021

Extreme weather events in 2021, including extreme cold, floods, severe storms, heat waves and a major hurricane, resulted in annual insured losses from natural disasters estimated at US$105 billion, the fourth largest since 1970, according to preliminary reports. Swiss Re Institute estimates sigma. Man-made disasters have generated another $7 billion in insured losses, resulting in an estimated global insured losses of $112 billion in 2021. While Hurricane Ida was the most expensive natural disaster in 2021, winter storm Uri and other secondary hazard events caused more than half of the total losses as wealth accumulation and the effects of climate change in disaster-prone areas generated claims. “In 2021, insured losses from natural disasters again exceeded the average of the previous ten years, continuing the trend of a 5 to 6% annual increase in losses seen in recent decades. It seems to have become the norm that at least one secondary hazard event, such as a severe flood, winter storm or wildfire, each year results in losses of more than $10 billion. At the same time, Hurricane Ida is a stark reminder of the threat and potential loss of peak hazards. Just one of these events hitting densely populated areas can strongly impact annual losses,” said Martin Bertogg, head of Cat Perils at Swiss Re.

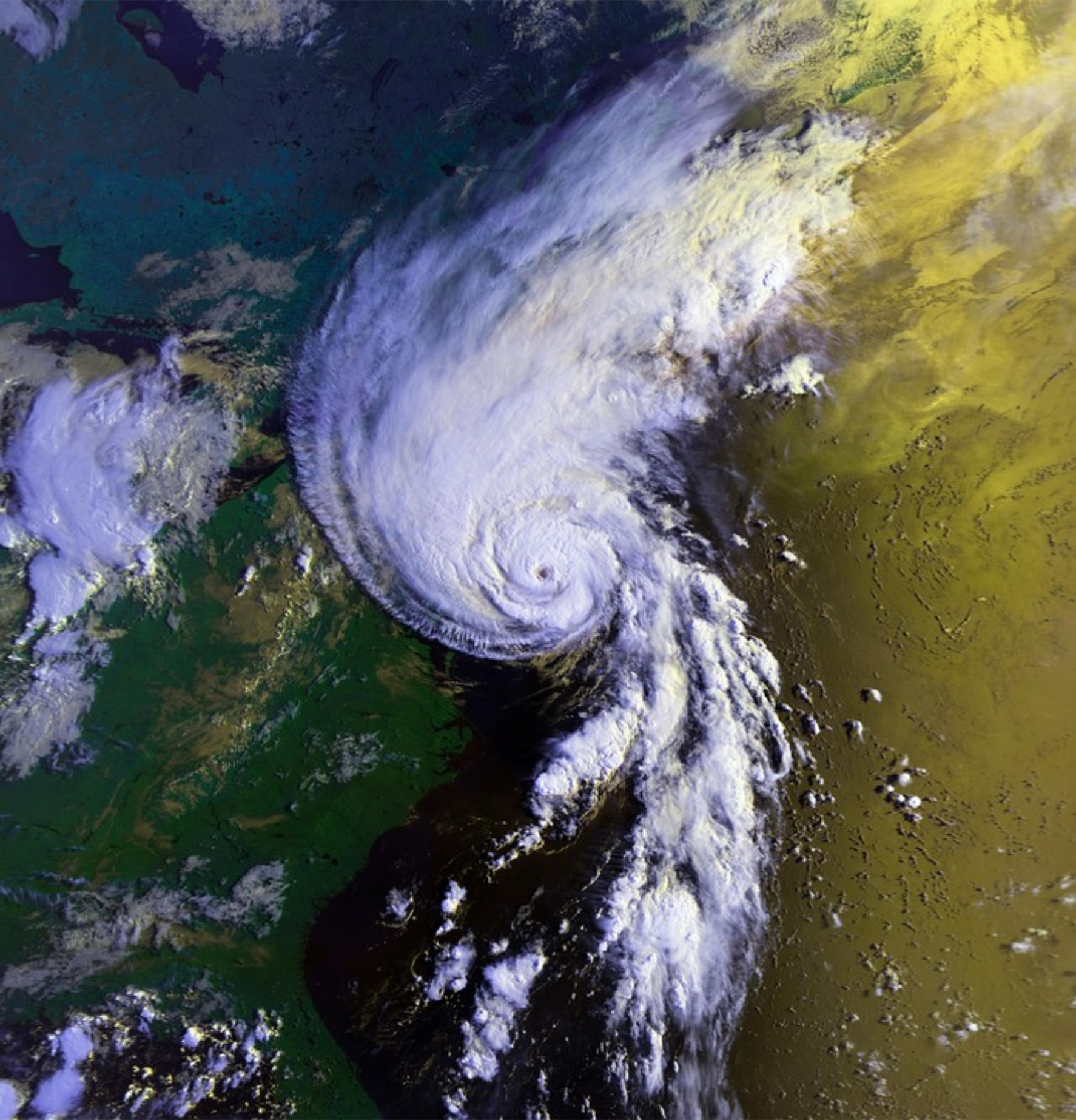

The two most expensive natural disasters of the year were registered in the United States. Hurricane Ida generated $30-32 billion in estimated damage to policyholders, including flooding in New York2, and winter storm Uri caused $15 billion in losses to policyholders. Uri brought extreme cold, heavy snowfall and ice accumulation, especially in Texas, where the power grid suffered several failures due to freezing conditions. The most expensive event in Europe, however, was the July floods in Germany, Belgium and neighboring countries, causing up to $13 billion in insured losses, compared to economic losses of more than $40 billion. This indicates a still very large flood protection gap in Europe. The flood was the most costly natural disaster for the region since 1970 and also the second largest in the world, after the 2011 flood in Thailand. “The impact of the natural disasters we have experienced this year once again highlights the need for significant investments in strengthening critical infrastructure to mitigate the impact of extreme weather conditions,” said Jérôme Jean Haegeli, Chief Economist, Swiss Re Group. ”Infrastructure investments support sustainable growth and resilience and need to be scaled up. In the US alone, the infrastructure investment gap to maintain critical and obsolete infrastructure averages $500 billion per year through 2040. In partnership with the public sector, the insurance industry is critical to strengthening society’s resilience to risk by investing in and underwriting sustainable infrastructure. ”

Other devastating secondary hazard activity in Europe included severe convective storms in June, with storms, hail and tornadoes causing widespread property damage in Germany, Belgium, the Netherlands, the Czech Republic and Switzerland. The resulting insured losses are estimated at $4.5 billion. In other parts of the world, severe flooding has occurred in the Chinese province of Henan and British Columbia in Canada, among others. On the other side of the extreme weather spectrum, Canada, adjacent parts of the US and many parts of the Mediterranean all experienced record temperatures in 2021. During the last days of June, a “heat dome” set a new all-time Canadian temperature record of nearly 50°C in a village in British Columbia. Temperatures in Death Valley, California, reached 54.4 °C during one of several heat waves in the southwest.

The exceptional heat used to be accompanied by devastating forest fires. However, the associated insured losses were lower than in recent years, when fires affected more populated areas. In California, forest fires have destroyed, in particular, large areas of forest, but, in contrast to 2017, 2018 and 2020, they invaded areas of lower concentration of property. These sigma catastrophe loss estimates are for property damage and exclude claims related to COVID-19. Loss estimates are preliminary and are subject to change as not all loss-making events have yet been fully evaluated. For example, catastrophic activity in December remained elevated and the resulting losses are still being evaluated. COVID-19 has lengthened the claims lifecycle, especially for large events, and will take much longer than usual to evaluate the final count.

Share